Salesforce Presentation at London Fintech Startups TMUFintech

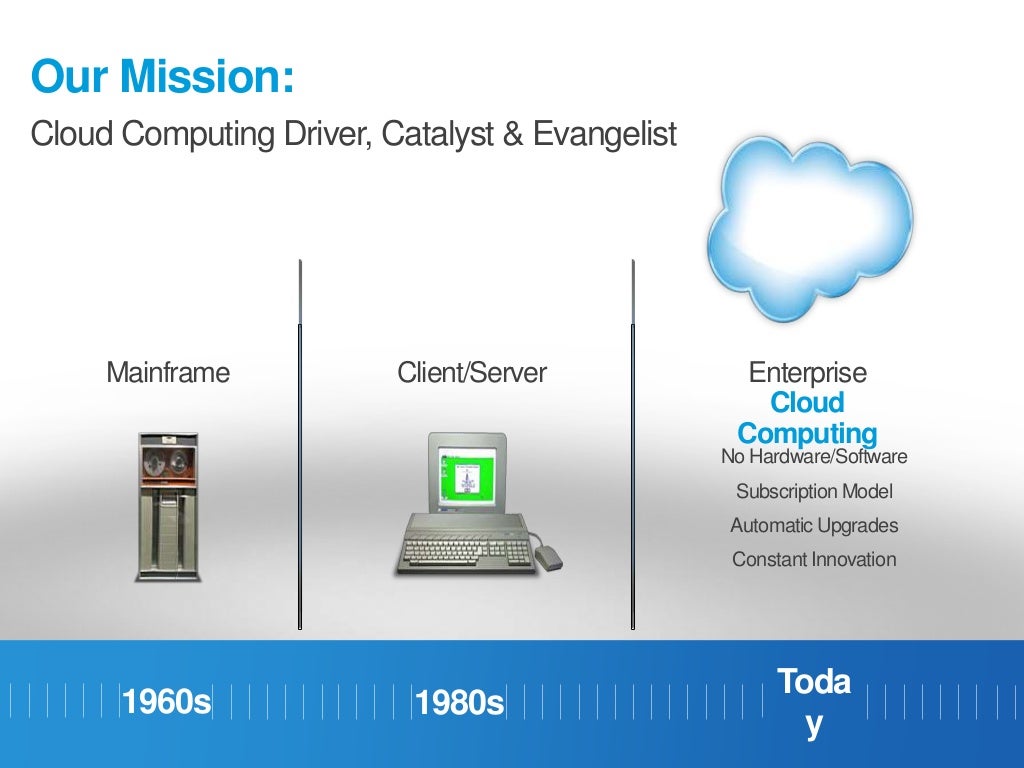

Since 2011, nCino and Salesforce have been empowering financial institutions with digital innovations that increase efficiency and transparency and reduce risks, while driving customer growth and loyalty. Now, that long-standing partnership has been expanded to accelerate the delivery of best-in-class cloud solutions to the financial services.

Salesforce Presentation at London Fintech Startups TMUFintech

Automates Daily Tasks and Activities. Salesforce CRM helps in automating routine tasks with ease. This decreases workload, increases performance, and reduces the chance of mistakes. Emails, voicemails, call reporting, lead prioritization, scheduling appointments, and other routine activities can be standardized. 7.

Top Reasons Why Salesforce Benefits FinTech Firms

The fintech market is substantially evolving and has an expected value of $698.48 billion by 2030, a considerable contrast to its $110.57 billion valuation in 2020. Today, almost 90 % of Americans now use fintech services. The apparent reason for this growth is the global quarantines and lockdowns that forced a shift towards more customer-centric digital financial processes. Fintech companies.

Top reasons why Salesforce benefits FinTech firms

All the challenges mentioned above can be overcome with Salesforce for FinTech, its integration and customization. Explore the Salesforce User Stories of FinTech market leaders in our recent blog post. Sparkybit is Salesforce consulting and development company. We make Salesforce perform at its best by fitting it to Clients' custom business.

Salesforce & FinTech Firms

Secure customers for life with Salesforce for financial services. The financial services industry is built on client relationships. That's why finance firms need a customer relationship management (CRM) solution. You can unify your teams with Salesforce's Customer 360 — a single flexible platform that puts the customer at the centre.

PPT Salesforce Mobile Development Benefits In FinTech Sector

Using Salesforce, your fintech firm can manage leads very effectively, monitor pipelines efficiently and sell your payment solutions much faster. The CRM powerhouse provides a 360-degree view of the client to all departments of your organization including marketing, sales and customer support, facilitating excellent engagement..

What Is The Salesforce CRM and How It Enhances FinTech Industry

Discover why Salesforce solutions are at the heart of FinTech. Want to enhance your connection with customers and the wider digital environment? Salesforce's connected CRM system makes this possible. PensionBee is one FinTech we have helped to achieve their goals. Find out more below.

Salesforce aims to boost fintech with Accelerate EMEA program Mobile

Here are the 5 reasons why many FinTech leaders have decided to use Salesforce to leverage their CRM and growth: 1. Personalized Customer Acquisition and Retention with Salesforce for FinTechs. Throughout every stage of the FinTech customer lifecycle, Salesforce lets companies provide their customers with highly personalized services.

Salesforce Presentation at London Fintech Startups TMUFintech

So putting Salesforce CRM to use in banks is the better choice. 3) Raise the rate of sales and lead conversion. One of the things that Salesforce CRM can do is connect to Sales Cloud. When Fintech companies connect Sales Cloud to Salesforce, it will improve Lead Generation, which will help your business get more sales.

Supercharging FinTech with Salesforce Revenue Cloud

Salesforce for FINTECH industry The priorities of financial institutions have shifted considerably over the past year, with such innovation and digital transformation now at the center of everything. Today, technologies like Salesforce set a solid foundation by making processes easier and more efficient, reducing errors, improving communication.

Fintech OS Demo Digital Sales Force Automation YouTube

The fintech sector draws multiple benefits from the Salesforce CRM solutions. 1. Customer-Centric Services. Fintech companies aim to bring financial services to users in a simplified form. The Salesforce platform helps provide a base for making business processes customer-centric to achieve this aim.

Best Salesforce Partner & Fintech Companies The Silicon Review

Why Choose Salesforce CRM For Fintech Companies Salesforce is a customer relationship management platform that is ideal for the financial sector. It provides transparency, speed, agility and other.

Salesforce Accelerate EMEA aims to help fintech startups scale higher

Salesforce has a built-in to manage security risks and ensure regulatory compliance. Salesforce's robust security infrastructure and compliance tools enable fintech companies to operate within a secure environment and comply with the restricted law requirements. Existing compliance practices promote a high adoption rate for Fintech solutions.

Benefits of Using Salesforce CRM For Fintech Companies

Tailored technology integrated into Financial Services Cloud enables the industry's transition to digital-first, helping deals get done from anywhere Provides bankers with stronger productivity, collaboration and compliance capabilities AI-based research tool allows bankers to uncover key client and prospect relationships SAN FRANCISCO—June 9, 2021—Salesforce (NYSE: CRM), the global.

ClearTax and Salesforce Join hands To Improve Customer Service

Introducing Salesforce is a pivotal tool which is widely used throughout the Fintech community, as it's built to scale and support growth, enabling connections to any API enabled solution. It is also easily customisable, fast to set up for new business functions and offers a huge network of Appstore partners which can be quickly introduced to.

Salesforce Mobile Development Benefits In FinTech Sector TheOmniBuzz

With Salesforce CRM, fintech companies can create new revenue streams, enhance customer loyalty, and drive financial inclusion and innovation. Salesforce CRM is the ultimate solution for fintech companies that want to grow and succeed in the embedded finance era.