What Is Retest? Why Retest Is A Safe And Strong Trading Strategy?

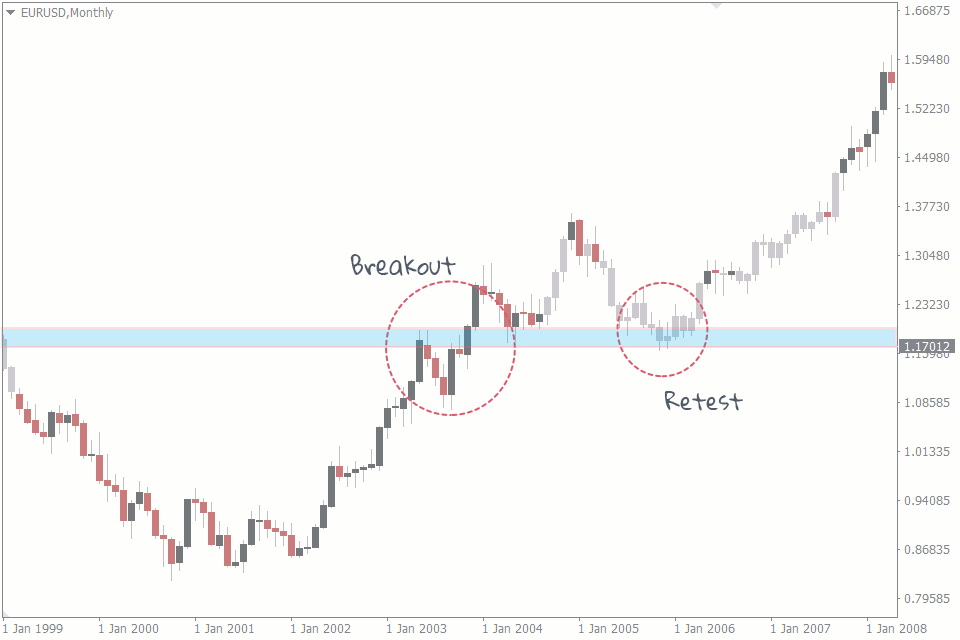

A break and retest strategy happens when an asset makes a bullish or bearish breakout and then retests the previous resistance or support and then continues moving in the original trend. How the break and retest strategy works The break and retest strategy works in a very simple way.

Waiting For A Retest Will Make You A Better Forex Trader

Retesting is a crucial tool in identifying potential trading opportunities in the forex market. It helps traders to identify levels of support and resistance and confirm their validity, which can be used to make informed trading decisions. Retesting Strategies

Forex Break and Retest Strategy Revealed

Tiếng Việt Indonesia Português فارسی There is a mantra in trading like this: "Keep calm and wait for a Retest". This is all that you need to do to make money in trading. So what is Retest? Why is it so magical? What are trading signals with high accuracy in the Retest trading strategy?

What Is Retest? The Most Effective Way To Trade Forex With Retest

The Break and Retest strategy consists of two vital eponymous components: Break and Retest. The two are a required to occur for the strategy to prove its sustainability. The mechanism begins its movement when an assets price peaks in momentum and breaks either the support or resistance level. High trading volume accompanies the event.

TRADING BREAKOUT+RETEST Stock trading strategies, Trading charts

What is a Retest in Forex? Retests in the Forex market come in all shapes and sizes. They can come after a market breaks a key horizontal level of support or resistance or a breakout from a wedge pattern. Regardless of how or where the retest occurs, the characteristics are the same.

Breakout and Retest Strategy in Forex Useful Trading Tips FXSSI

Break and retest example. The pair then resumed the upward trend and moved above the resistance and finally broke out lower. Therefore, in this case, a trader would have placed a sell-stop at 1.4026. Summary. A break and retest is a good forex trading strategy that is also easy to use.

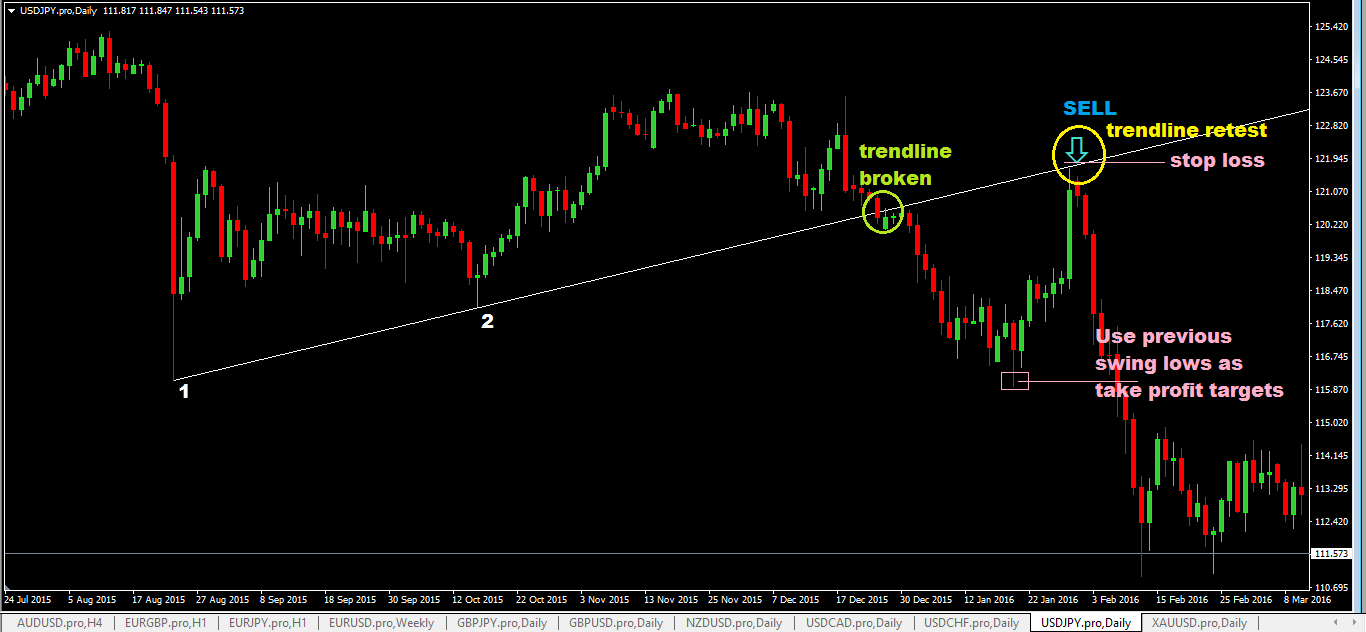

Trendline Retest Forex Trading Strategy

The breakout and retest strategy is the one that many traders adopt when trading forex trendline breakouts or support and resistance levels. The strategy is designed to help forex traders do two main things. The first is to avoid false breakouts.

Forex Break and Retest Strategy Revealed

The break and retest strategy is a common and effective way to trade forex. This approach can help you capture big moves in the forex market, avoid false signals and improve your risk-reward.

What Is Retest? The Most Effective Way To Trade Forex With Retest

A retest in forex trading refers to a price level that has previously been broken and is subsequently tested again by the market. When a support or resistance level is broken, it can become a new support or resistance level.

What Is Retest? Why Retest Is A Safe And Strong Trading Strategy?

0. In forex trading, the term "retest" refers to the situation where the price of a currency pair retraces to a previous level that it had previously broken through. This is a common occurrence in the forex market, and traders need to understand what it means and how to use it to their advantage. A retest occurs when the price of a currency.

Break And Retest Forex Technical Analysis

Examples of good currency pairs to use in our London open Forex strategy are GBP/USD, EUR/USD and the highly volatile GBP/JPY. Timeframes: Our London open Forex strategy is an intraday strategy. It requires you to mark the Asian session range, so find the best intraday timeframe below the D1 chart that works for you.

Why Does the Break and Retest Strategy Work Price Action Trading

A retest can be conducted by looking for a candlestick pattern to form or by waiting for the price to reach a certain level on the chart. A retest is a technical analysis term referring to the testing of a former support or resistance level as a new support or resistance level. A retest can also refer to the testing of a breakout level.

What Is Retest? Why Retest Is A Safe And Strong Trading Strategy?

The best forex trading platform in Australia for 2023 is Pepperstone according to Finder's latest analysis. It achieved high scores across the board thanks to its vast range of tradeable.

What Is Retest? Why Retest Is A Safe And Strong Trading Strategy?

A retest in forex trading is a price action that occurs when the market price approaches a support or resistance level, breaks through it, and then retraces back to test the same level again. The purpose of a retest is to confirm whether the broken support or resistance level has become a new support or resistance level.

What Is Retest? Why Retest Is A Safe And Strong Trading Strategy?

The real retest: Price broke the 20 SMA and then put in a range with a clearly defined support level. Price tested the 20 SMA multiple times but only once price broke the support with strong momentum (remember the momentum video from above) was the retest confirmed and price showed enough momentum that a high probability pattern existed.

What Is Retest? Why Retest Is A Safe And Strong Trading Strategy?

6 Summary What is Retest? Retest is the process of the price bouncing back to the level that the market has previously broken. I will explain the above definition through 4 of the most popular Retest patterns encountered in the market with specific illustrations. (1) The price breaks out the resistance level and retests